For many years, investors have seen their buy-to-let properties as an excellent source of income. However, the Government has acknowledged the need to discourage savvy investors from procuring properties that would otherwise have been sorely welcomed by first time buyers.

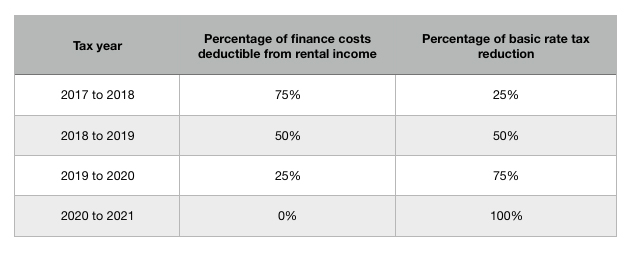

As of 6th April 2017, a phased implementation began of new rules, designed to restrict the relief available for higher rate taxpayers. When calculating taxable profits, landlords will no longer be allowed to deduct the interest costs of their mortgage. In its place, tax relief on mortgage interest payments will be reduced incrementally until 2020, with tax calculated on the total rental income instead.

Despite the changes taking place gradually until 6th April 2020, the changes could have huge implications for individuals that are near the higher tax rate threshold. For those with high interest costs, the new rules could push them over the tax threshold without them being aware.

For detailed information on how these changes will impact investors go to the GOV.UK website where there are some clear examples on what this means in practice. Essentially though, the changes certainly mean larger tax bills for property investors and in turn lower profits.